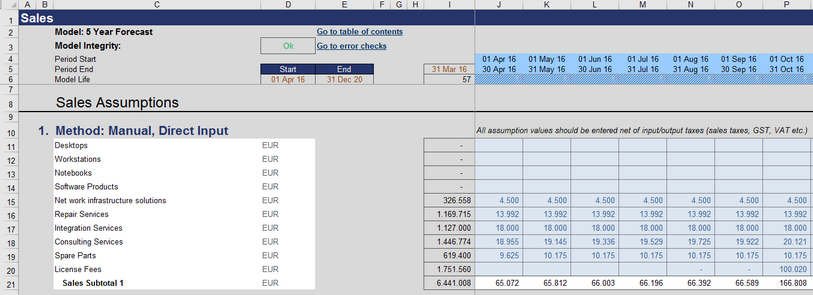

Sheet Sales

Sales Forecast

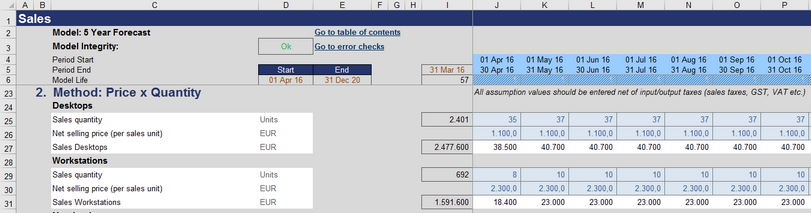

For each product/service two different options for sales planning are included in the model. You can choose either one of them or even combine both methods to achieve an appropriate forecast.

1.Direct Input:

Fill in estimated revenues for each month. It is also possible to use/insert formulas to implement escalations or you are free to link in cells/rows from a more detailed, separate calculation of your own (eventually integrated on a separated sheet or section within your workbook).

2.Price x Quantity:

As revenue for a given period is generally a result of price times quantity, you can enter any sales quantities and net selling prices for all products/services and months.

If you combine both methods for numerous products/services you may find it helpful to have an overview of the totals at the bottom of the sheet. This summary will also be used for the calculation of GST/VAT, taking into account optional bad debts.

|

Note All assumption values should be entered net of input/output taxes (like VAT, GST or Sales Taxes) |